"Health is like money; we never have a true idea of its value until we lose it."

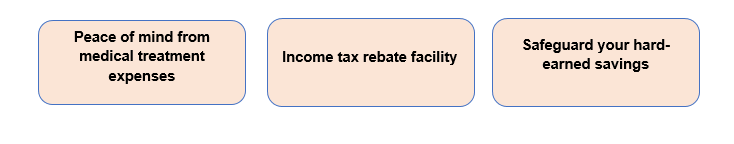

You cannot enjoy wealth if you are not in good health. When you are thinking about taking care of yourself, health insurance would be your ultimate backup plan. In case of a medical emergency, health insurance permits you to focus on getting better instead of worrying about medical bills.

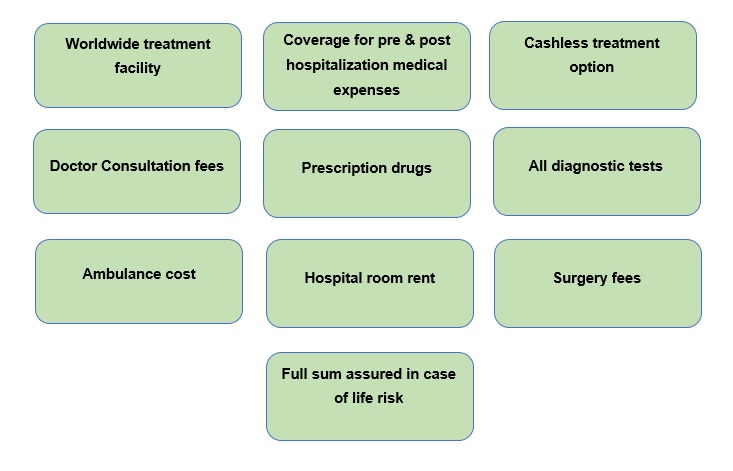

Our Health Insurance covers hospital bills and all the medical treatment-related expenses you might face before and after hospitalization. Along with this, we also have life insurance coverage with it. So, you can lay back and relax, knowing Pragati Life is always there to save you when a medical emergency knocks at the door.

Pragati Life is a trusted name in the field of life insurance in Bangladesh since 2000. With 250+ network hospitals and 25,000 agents and branches, our objective is to make health insurance accessible for everyone so that you can stay at absolute peace of mind!

Anyone with financial dependents should buy a Health Insurance Policy. This includes:

- Young professionals with dependent parents

- Married couples

- Parents

- Business people

- Self-employed

According to Section 44(2) of Income Tax Ordinance 1984, premiums will be admissible for income tax rebate. Hence, it carries double benefits for taxpayers—protection and tax savings.

Ready to secure your health and peace of mind? Get started with Pragati Life's Health Insurance today!

- Worldwide treatment facility

- During hospitalization - All diagnostic tests - Doctor consultation fees - Surgery fees

- 15 days treatment cost before admission in hospital

- 30 days treatment cost after discharge from hospital

- Ambulance cost

- Nominee will get full sum assured in case of death

- Income Tax rebate facility

- Up to 45% discount in 250+ networked hospital & diagnostic center

| Coverage | Plan 1 (Co-Payment 15%) | Plan 2 (Co-Payment 10%) |

|---|---|---|

| Life risk | BDT 5,00,000 | BDT 10,00,000 |

| Hospitalization | BDT 5,00,000 | BDT 10,00,000 |

| Room & Board Charge (Maximum) per day | BDT 5,000 | BDT 10,000 |

| ICU / CCU / HDU | Full Reimbursement | Full Reimbursement |

| Inpatient hospital costs, Operation Theatre fees, Medicines and dressings, Doctors /Surgeons fees, Nursing fees, Diagnostic tests (pathology, X-Rays, MRI, CT, PET scans), Physiotherapy and other therapeutic treatments (Insurer do not pay for Non-medical or personal items.) | At actual | At actual |

| Surgical Expenses Limit | Full Reimbursement | Full Reimbursement |

| Local Ambulance transport expense limit in case of emergency (per disability) | BDT 2,000 | BDT 2,000 |

| 15 days Pre-hospitalization, Investigation & Consultation fees | Full Reimbursement | Full Reimbursement |

| 30 days Post hospitalization, Investigation & Consultation (maximum 2 visits) | Full Reimbursement | Full Reimbursement |

| Investigation (In Patient) | Full Reimbursement | Full Reimbursement |

| Consultant Fee (In Patient) | BDT 2,000 /Day | BDT 4,000 /Day |

| Ancillary Services maximum (Excluding Bed charges, investigations, surgery/procedure fees, medicines) | BDT 25,000 | BDT 50,000 |

| Exclusions | ||

| Organ Transplant (Donor) | Not covered | Not covered |

| Repatriation of remains | Nil | Nil |

| Pre-existing diseases cover | 2 years Waiting Period | 2 years Waiting Period |

- Proposal form

- Health related questionnaire

- NID/ Passport/ SSC certificate

- Passport size picture

- Nominee list

An Insured need to submit following documents duly attested by him:

- Original bills, receipts and discharge certificate/card from hospital

- Medical history of the patient recorded by hospital

- Original cash-memo from the hospital/chemists supported by proper prescription

- Original receipt, pathological and other test reports from a pathologist/radiologist including film etc. supported by the note from attending doctor demanding such test

- Attending consultants/Anesthetists/Specialists’ certificates regarding diagnosis and bill receipt etc. in original

- Surgeons original certificate stating diagnosis and nature of operation performed along with bills/receipts

- Any other information required by us